Santa Monica Sales Tax Rate 2025. Recently released 2025 1 st quarter sales tax reports for the city of santa monica show positive trends. The sales tax rate in santa monica, california is 10.25%.

The combined sales tax rate for santa monica, california is 10.25%. Measure y, which was passed by over 60% of the voters on the november 2nd ballot, increases the city’s tax rate from 9.75 percent to 10.25 percent.

The 10.25% sales tax rate in santa monica consists of 6% california state sales tax, 0.25% los angeles county sales tax, 1% santa monica tax and 3% special tax.

The sales tax rate for santa monica was updated for the 2025 tax year, this is the current sales tax rate we are using in the.

New California city sales tax rates take effect on April 1 Business, Tax rates are provided by avalara and updated monthly. How 2025 sales taxes are calculated for zip code 90404.

Santa Monica Sales Tax Soars To 10.25 Percent Canyon News, Average sales tax (with local): The santa monica sales tax calculator allows you to calculate the cost of a product (s) or service (s) in santa monica, california.

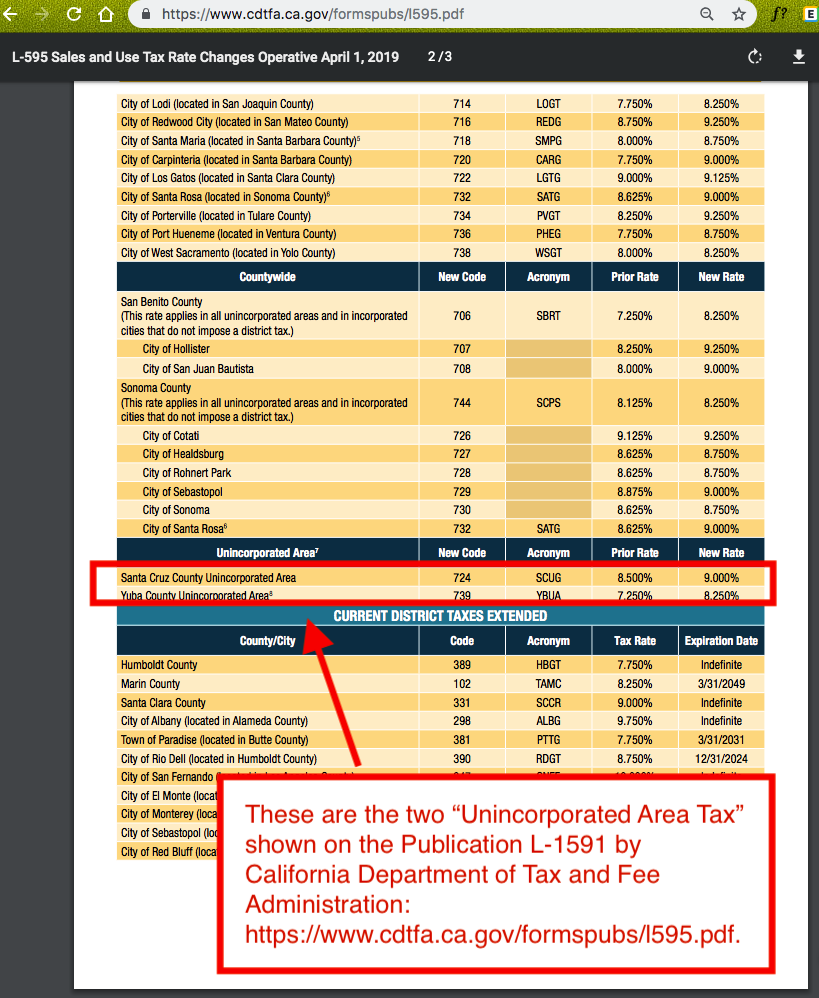

How to Calculate California Unincorporated Area Sales Tax, This county tax rate applies to areas that are not within the boundaries of any incorporated city within the county of santa cruz: The 10.25% sales tax rate in santa monica consists of 6% california state sales tax, 0.25% los angeles county sales tax, 1% santa monica tax and 3% special tax.

10 Year Charts for Santa Monica Multifamily Sales San Diego, Tax rates are provided by avalara and updated monthly. The latest sales tax rate for santa monica, ca.

Tax Brackets 2025 Single Person Angil Meghan, Average sales tax (with local): The latest sales tax rate for santa monica, ca.

10 Year Charts for Santa Monica Multifamily Sales San Diego, While many other states allow counties and other localities to collect a local option sales. Average sales tax (with local):

Santa Monica sales tax revenues grow Santa Monica Daily Press, Tax rates are provided by avalara and updated monthly. The sales tax rate is always 10.25%.

Find the Best Tax Preparation Services in Santa Monica, CA, Measure y, which was passed by over 60% of the voters on the november 2nd ballot, increases the city's tax rate from 9.75 percent to 10.25 percent. The 10.25% sales tax rate in santa monica consists of 6% california state sales tax, 0.25% los angeles county sales tax, 1% santa monica tax and 3% special tax.

Santa Monica sees a small decline in sales tax figures as inflation, The santa monica, california sales tax is 7.50%, the same as the california state sales tax. Every 2025 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25%), the california cities rate.

10 Year Charts for Santa Monica Multifamily Sales San Diego, Sales tax in santa monica, california, is currently 10%. This rate includes any state, county, city, and local sales taxes.